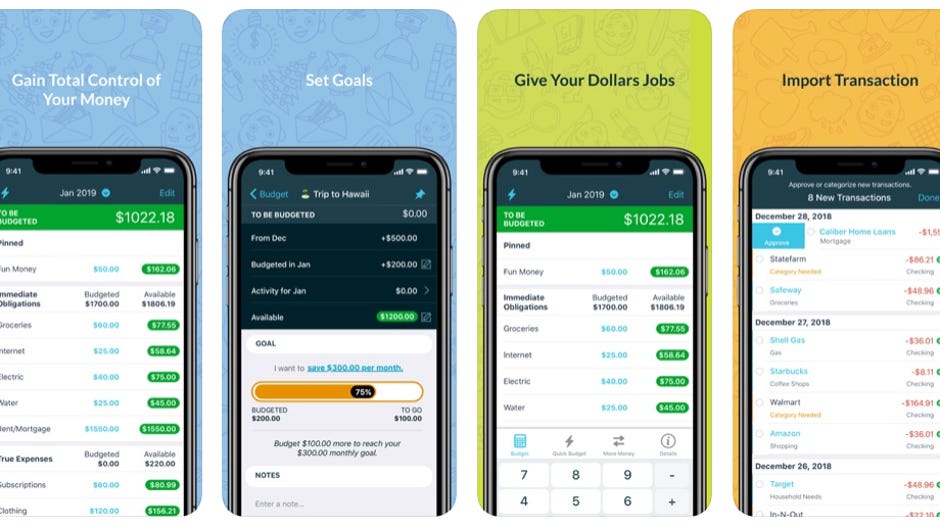

The app/methodology/paradigm(s) have really revolutionized the way I approach my own finances and i cannot recommend it enough from that regard as a service & function. I highly recommend it for those who want to be in charge of their spending habits. But the phone app is essential for quickly checking your remaining budgets on the go, especially as you get close to your next payday. The web platform is easiest to use for setting up your categories, and for reconciliation. But they produce tutorials that explain it well.

That is not intuitive the way the rest of the program is. The only tricky bit is understanding how YNAB budgets your credit card purchases. It shows monthly and quarterly reports so I can see trends over time. But then I spend 1 to 3 minutes each morning reviewing the previous days expenditures, and maybe 10 minutes a month reconciling my accounts.

YOU NEED A BUDGET APP HOW TO

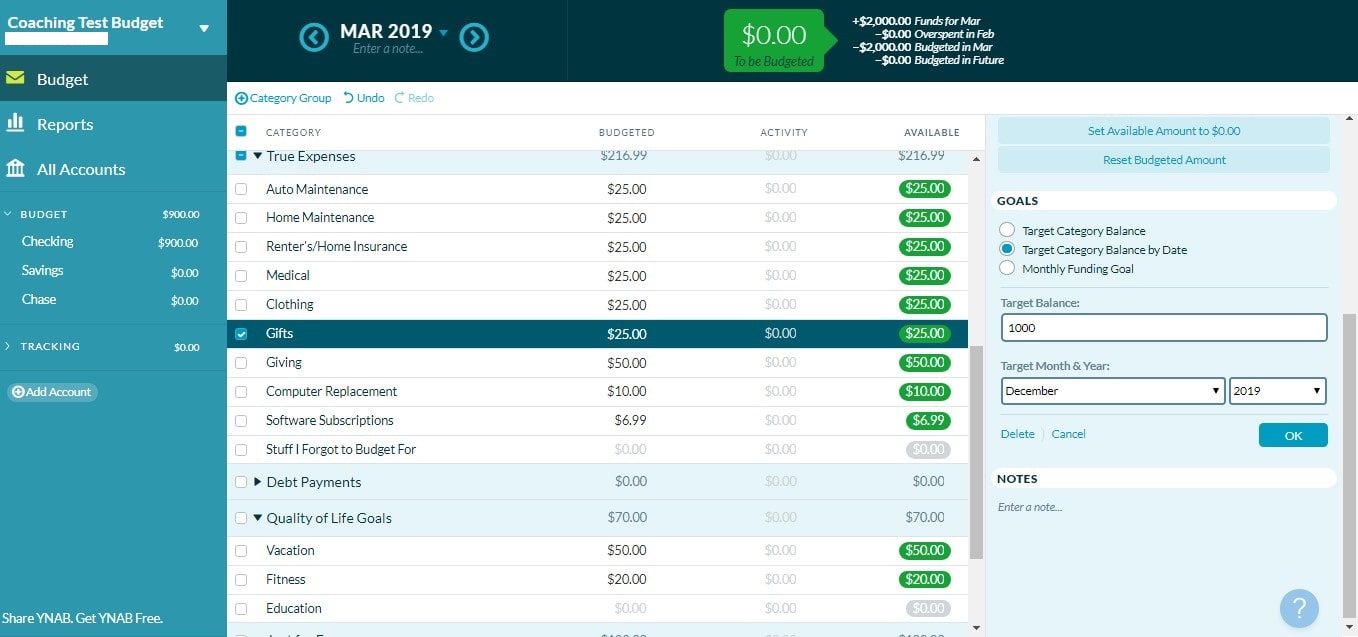

Do watch the tutorials first on how to set it up. In the beginning it does take a few hours to set up categories and get banks connected, mainly because it is so customizable, but once it is set up it is virtually effortless to maintain. But YNAB did a good job of communicating how they were working to resolve the issues. The only issues I’ve had were with banks making it hard to set up connectivity. I found the program itself is well designed, reliable, and easy to use. The beauty of YNAB is that it is flexible and dynamic, and allows you to adjust your spending plan as you need to. Which is the problem: once you set it, you forget it and you drift away from your spending plan. Most budget programs are set it and forget it. Subscription to that publication, where applicable.

YOU NEED A BUDGET APP TRIAL

Any unused portion of a free trial period, if offered, will be forfeited when the user purchases a Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user’s Account Settings after purchase. Account will be charged for renewal within 24-hours prior to the end of the current period. Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period. Payment will be charged to iTunes Account at confirmation of purchase. YNAB is a one-year auto-renewable subscription, billed monthly or annually. The YNAB budgeting app and its simple four-rule method will help you demolish your debt, save piles of cash, spend without guilt, and reach your financial goals faster.įree for 30 Days, Then Monthly or Annual Subscriptions Available

Tired of timing bills to pay day? Frustrated that you make OK money, but have nothing to show for it? been using YNAB for over 2 years, and in 23 days my fiance and I will be paying for our wedding without any loans because of YNAB. I’ve never been so financially aware in my life.” just don’t know what I’d do without YNAB. With YNAB, I was able to double the goal! Bye, financial stress!” years ago I started with YNAB, the goal was paying off all my debt. Absolutely love it!” - never, ever, ever thought I’d see this, and yet here it is: CREDIT CARD BEAST DEFEATED! Props to which helped me get it done!” “YNAB is the first budgeting app I’ve ever used, stuck with, and that has made sense. Award-Winning Customer Support: Ask our award-winning support team your budgeting questions anytime via email or live chat.When you open your budget app, it’s just that-your budget. We don’t pitch you recommended products in-app. No Ads: We don’t (and won’t) sell your data.

YOU NEED A BUDGET APP FULL

See your average grocery spend (down to the cent) and your growing net worth in full technicolor glory.

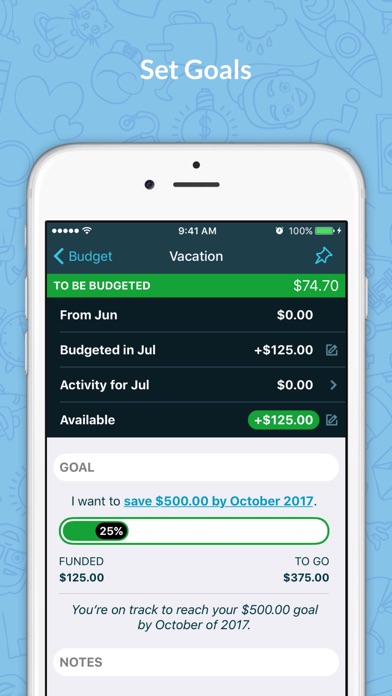

Create categories for your financial goals and see your progress at a glance.

0 kommentar(er)

0 kommentar(er)